The New Open Banking Integration Is Here!

We have great news! We’re rolling out a new bank integration system that will allow you to connect Companio with hundreds of banking solutions in a faster, more secure, and more reliable way!

What does it mean for you?

First, there are hundreds of new banking solutions available for you to choose from! From well-known online solutions such as Revolut Business to most Estonian banks (including SEB, Swedbank, and Coop), and later this summer, Paypal too!

Also, we have doubled down on security. The new access is even more secure and reliable. We only ask for the minimum access permissions we need, and you have to renew your authorization every three months. You are in control.

We will have to ask you to reconnect some of your bank accounts. If you have a Revolut Business, LHV, SEB, or Swedbank account, please access Companio and reconnect them to the new system.

During the migration process, it may happen that a small number of transactions get duplicated. If that happens, we will mark that transaction as a possible duplicate and you will be able to delete them from the Bank Movements section. Otherwise, just let us know and we’ll do it happily for you.

Why are we making these changes?

Well, there are two important reasons.

First, with the advent of the new banking regulations and the Open Banking standard, banking providers are required to adapt their systems to the new directive. That means most of them changed their connection APIs to the Open Banking interface, so it was no longer possible for us, third-party providers, to simply connect to their APIs and get your financial data. A more secure and reliable protocol is required.

That means that providers won’t allow us to get the bank information from you like we used to do. We have no choice but to migrate to the new system if we want to keep on offering you the same level of quality in our services.

Also, the new integration means we will be able to connect to hundreds of new banks. Through our partnership with Nordigen, a reputable AISP (we explain this term below), we are able to offer you a secure integration with literally hundreds of banks, including most Estonian banks, and fintechs such as Revolut Business, and more.

Our goal is to automate your management tasks as much as possible so you can focus on what really matters: growing your business.

What is an AISP?

In the new Open Banking paradigm, only certain businesses with specific requirements, reputation, and an official license, can access to your financial data. These are called AISP: Account Information Service Provider(s). They are authorised to retrieve account data provided by banks and financial institutions.

How secure is this access? Very secure. To become regulated as an AISP, a company must undergo a rigorous application process with the Financial Authorities. They won’t access or read your data. They just ask as a proxy (always under your control) to grant permission to third parties such as ourselves to read (never modify) your information. To work with them, we had to be verified too, so there is a trust chain between your financial data and you, as the user who grants authorization to access your financial information.

But now I have to reconnect my bank account every three months!

That, unfortunately, does not depend on us. Even though it would be more convenient for us to have full-time access to your bank statements and movements, the new PSD2 directive specifies a maximum timeframe of 90 days to access your bank statements with each authorization from the user. This means that the system will only give us 90 days to get your data. It’s also true that, security-wise, it’s much better if you keep in control of the financial information of your company.

Still, reconnecting your account every three months is better than uploading your bank statements manually, and we’ll do our best to let you know when the date to renew your authorization is approaching.

So how does the new process look like? How do I link or reconnect my bank accounts?

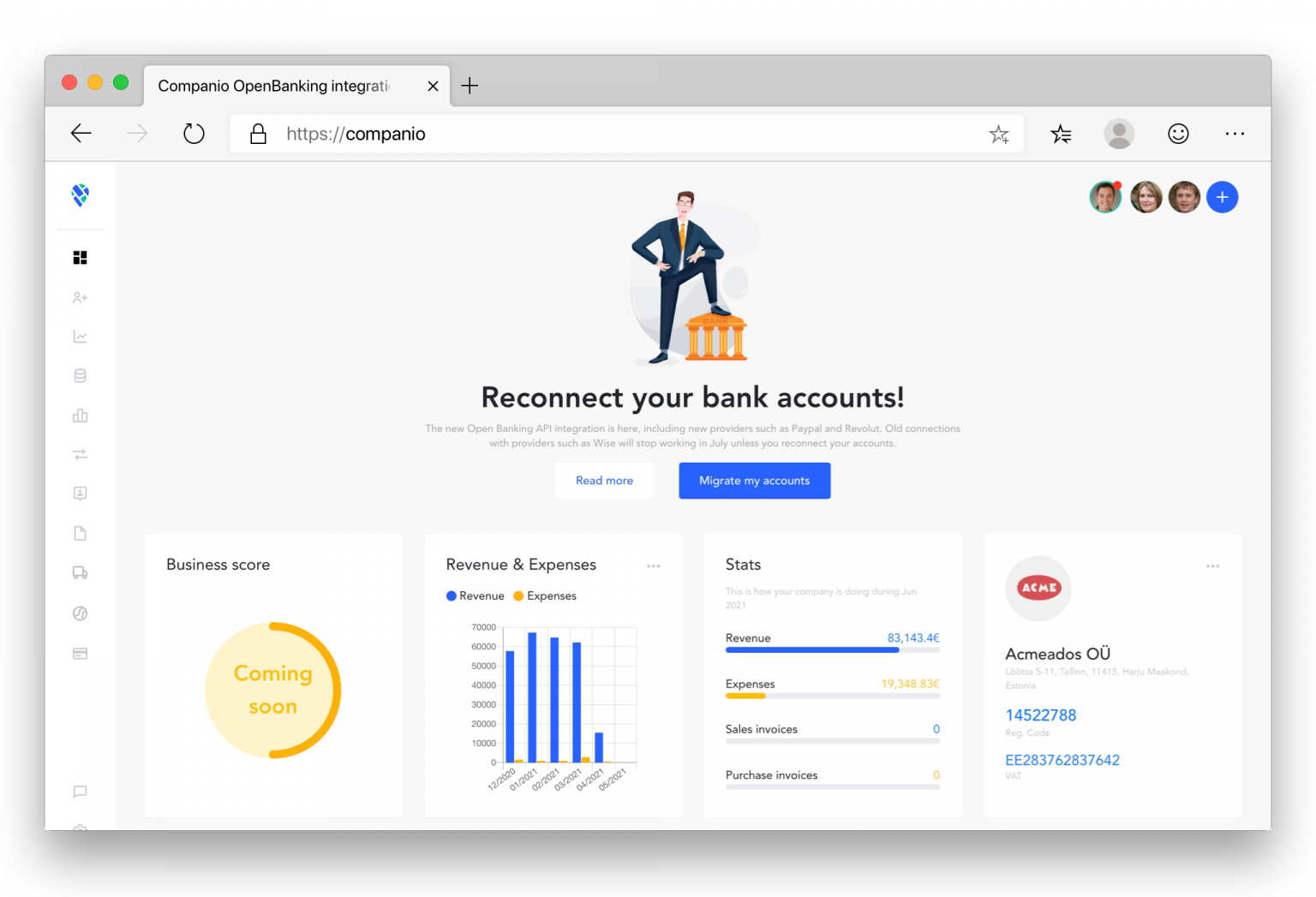

Ok, let’s go straight into it. It all starts in Companio. If you need to migrate any of your bank accounts, you will see a message asking you to do so.

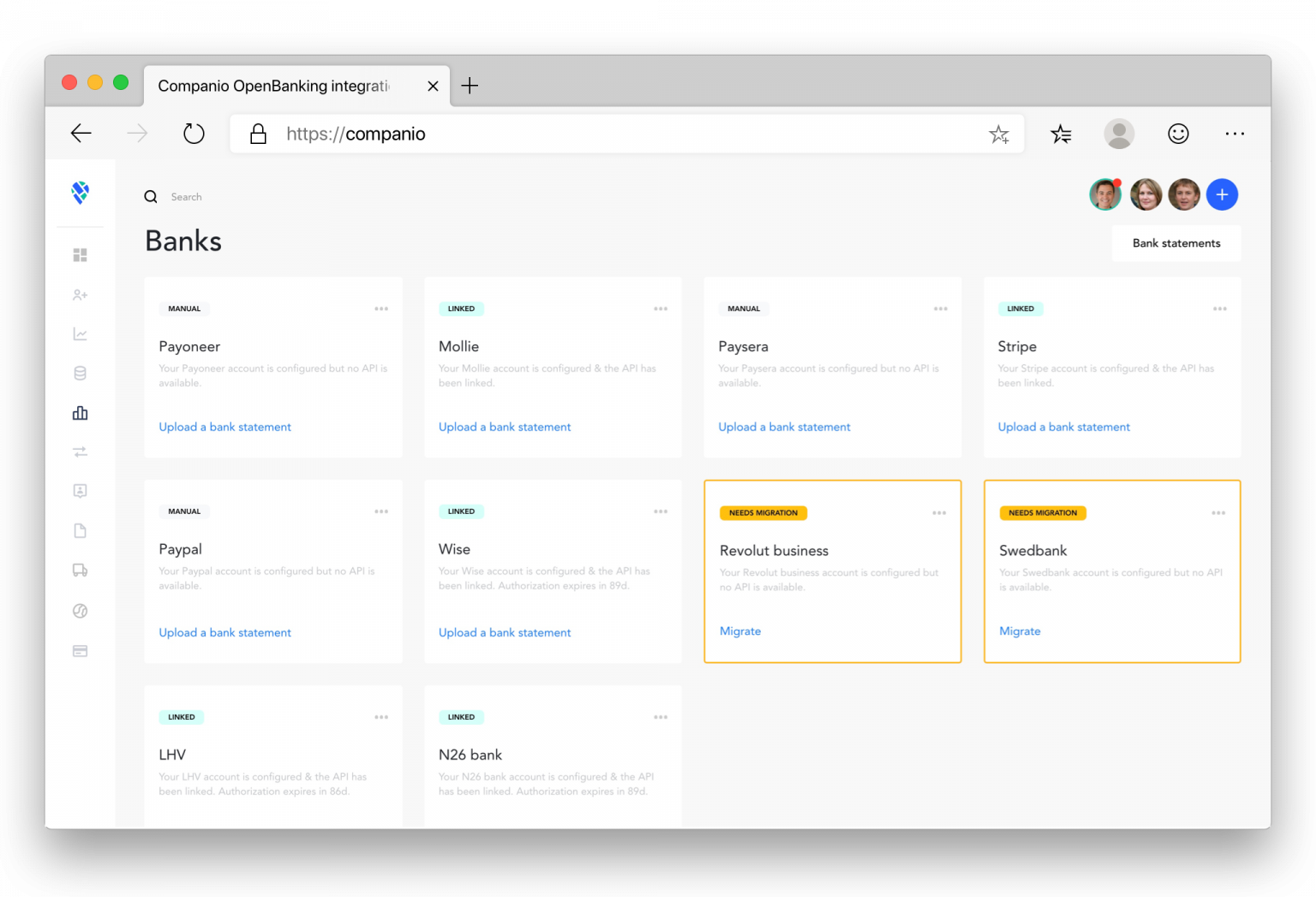

Otherwise, if you enter the Banks section, you will see a “NEEDS MIGRATION” notification on those accounts you need to migrate.

If you click on “Migrate”, you will be taken to the new Banking Connection interface.

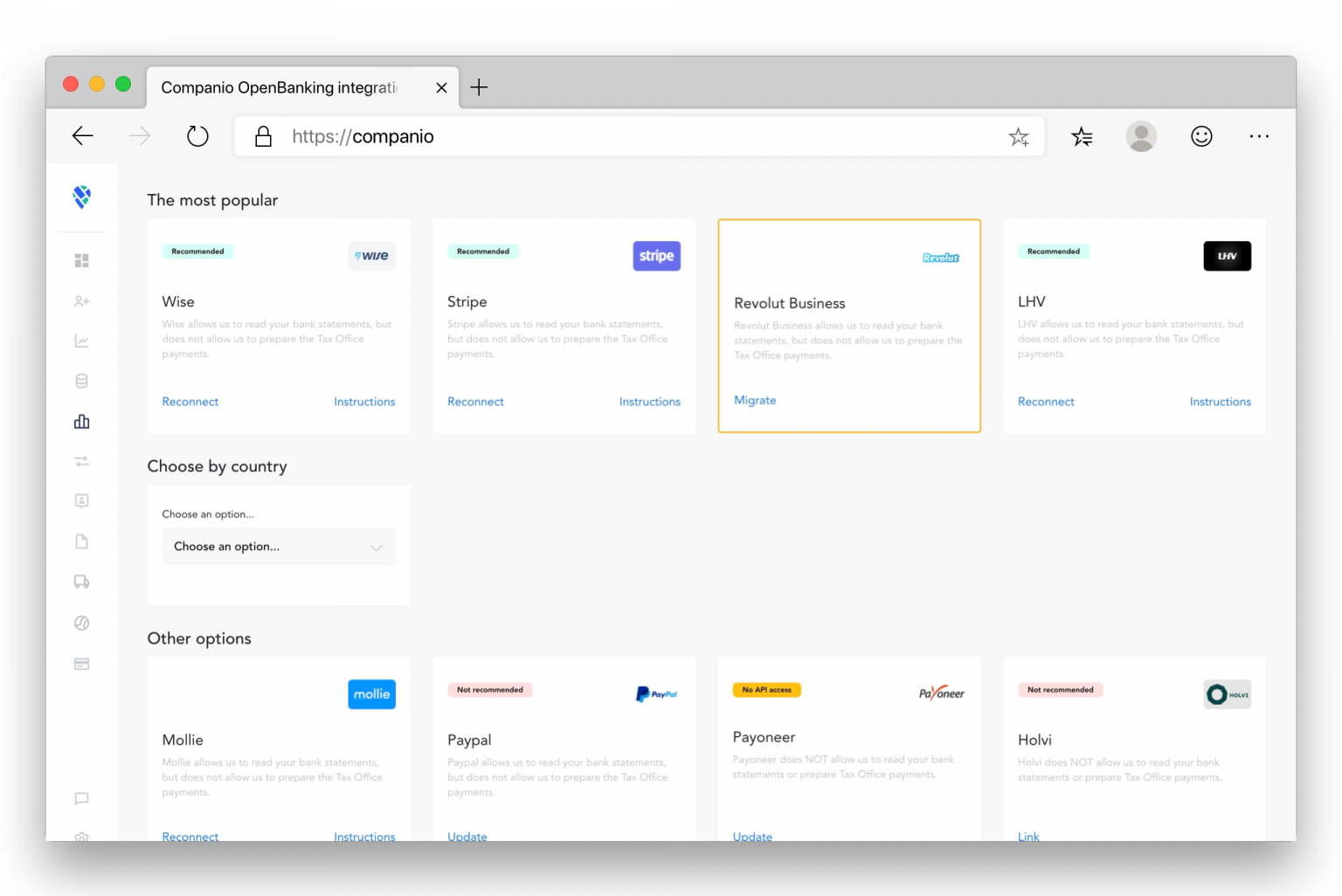

ou have different wais of finding the banks you need to migrate. All of them will appear with a yellow border. The most popular ones appear on top (Stripe, Revolut Business and LHV). At the bottom, you will see less-used options such as Swedbank, SEB or Paypal. Finally, you can also look for a banking solution by country. As you know, Estonia allows your company to have a bank account in any country of the EEA.

When you are ready, just click on the Migrate button.

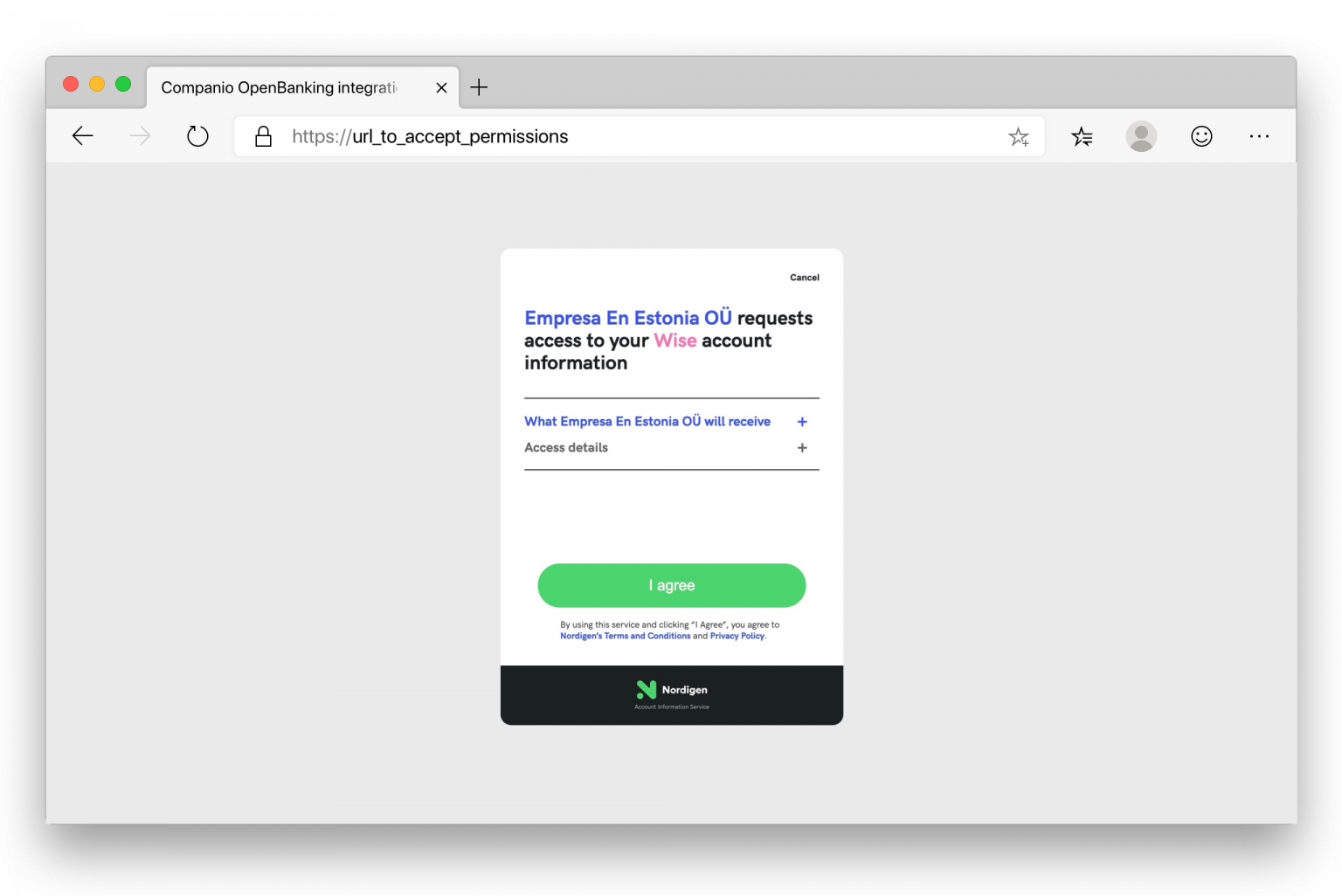

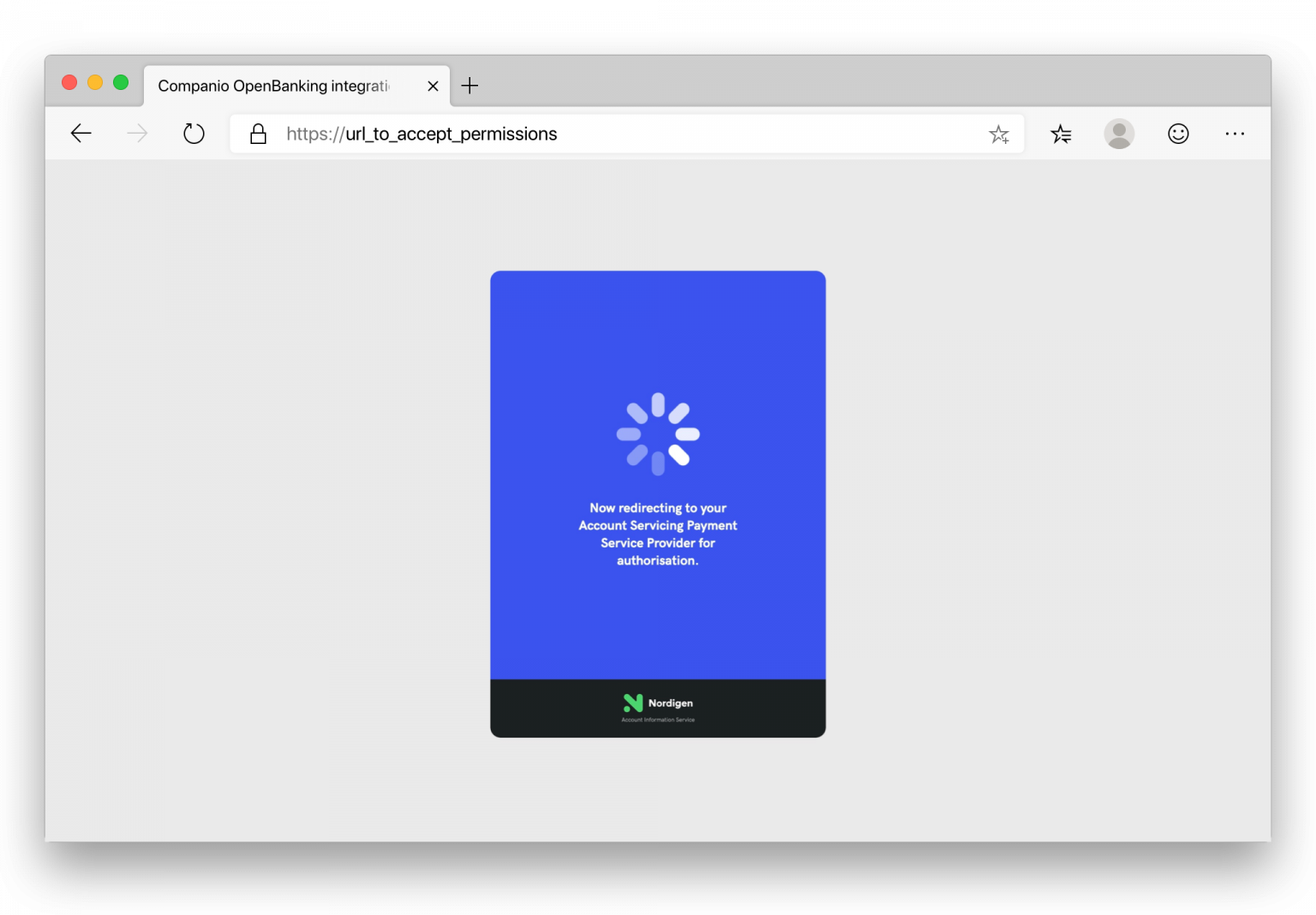

First, you will see the authorization form of our AISP. There, you’ll be able to check all the permissions we are requesting, and for how long. As you ca see, we ask for read-only permission to the relevant information (including transfers, recipients, and invoices).

Depending on the bank you’ve chosen, you will be redirected to a different location.

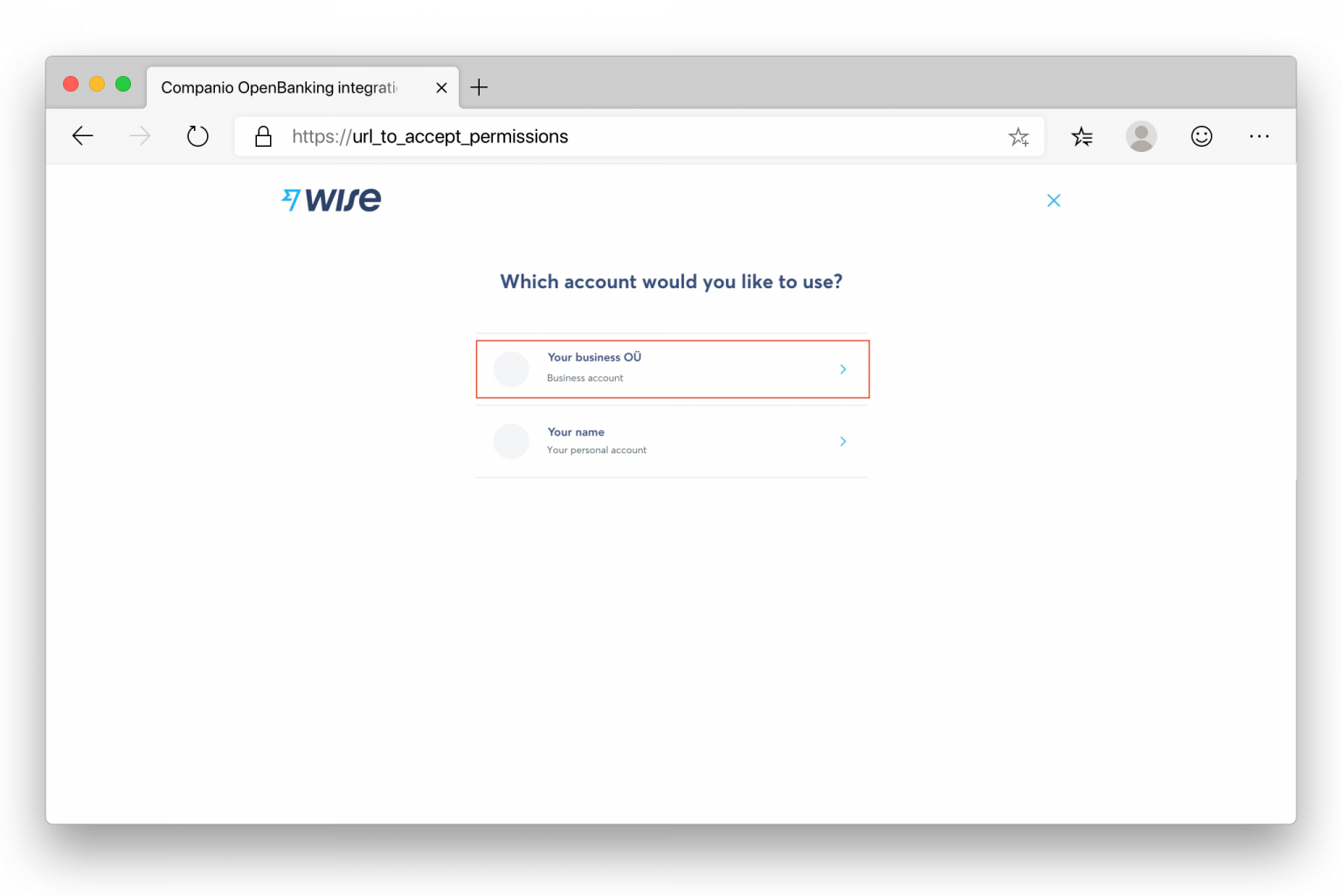

Let’s see, for example, the case of Wise. Wise has a well-known bug that will make the connection fail sometimes if you are not logged in. Our recommendation is: access your Wise account first in a separate tab of the browser and then, try the integration from Companio.

You will be asked to log in, if you haven’t already. Then, you will be asked to choose the account you’ll be integrating. Make sure to choose your company’s account, NOT your personal one.

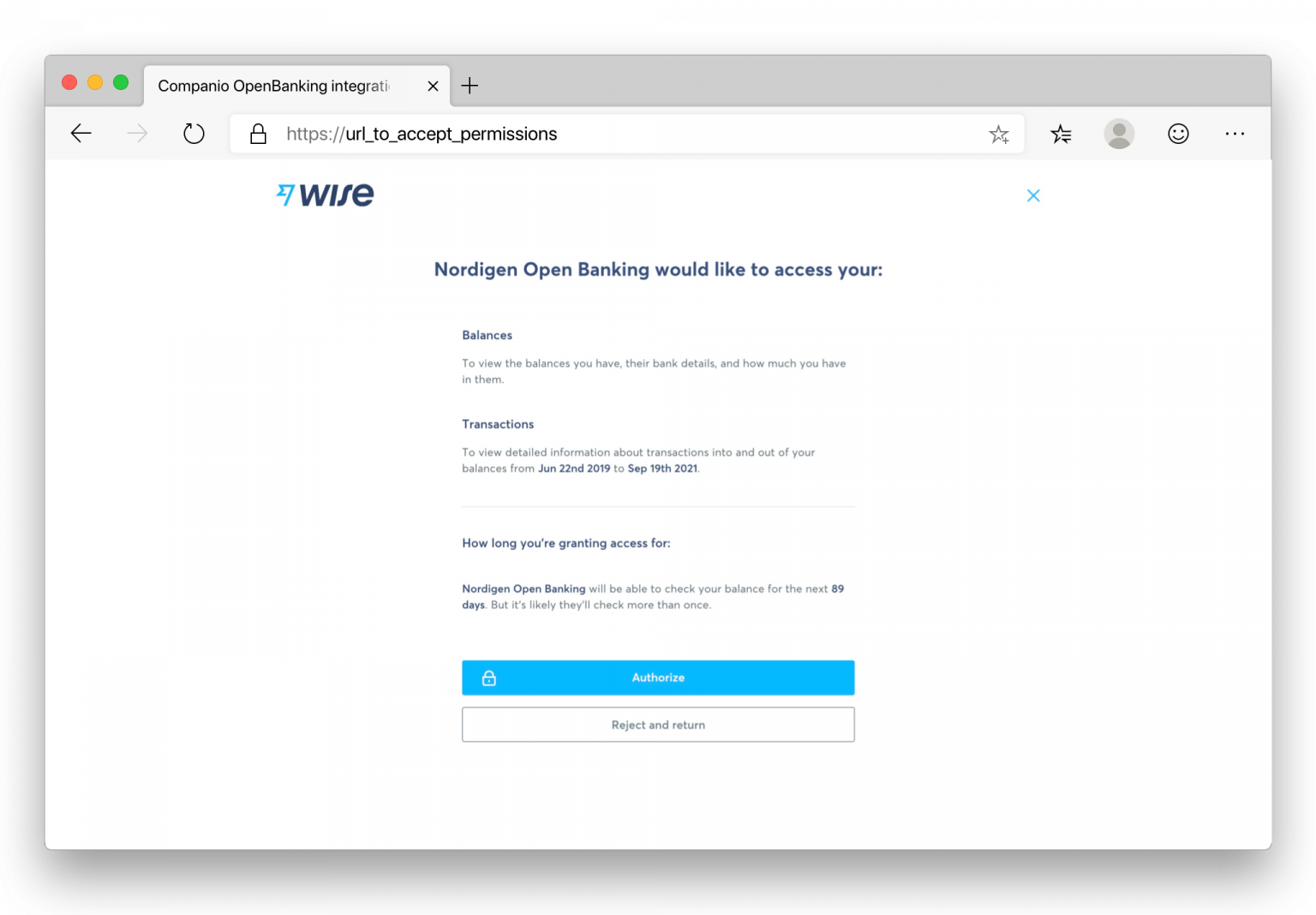

Then, you will get a detailed summary of the permissions you are granted. Here, the name of our AISP will show, not ours, so if you see that another company is requesting permission, that’s normal. They are the ones who can provide access to your data.

Click on “Authorize” and wait for a couple of minutes while we connect the new account, migrate the old one if required, and retrieve the bank movements. This may take a while, so please do’t close the browser’s tab.

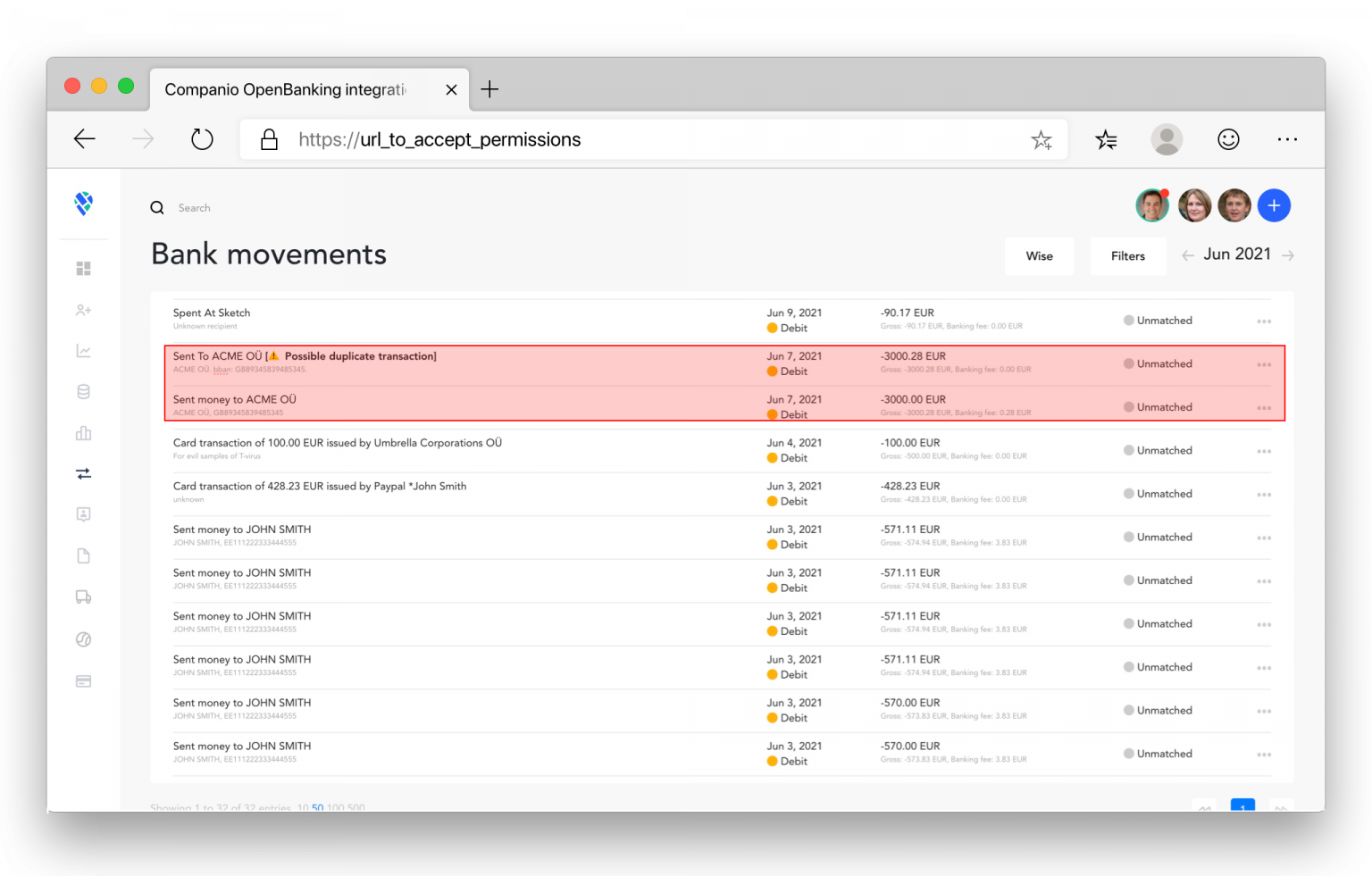

When everything’s done, you will be able to see the movements in the dashboard under “Bank Movements”.

You may notice some minor differences between the old system and the new one, especially with regards to fees (that now are included as part of the transfer), and minor changes in the names or recipients of the transfers.

Duplicate transactions?

Migrating from one banking integration system to another is complicated. We’ve done our best to make sure the migration process is as smart and smooth as possible. However, it may happen that some transactions (especially those that just arrived recently to your account and are not settled yet) may be retrieved twice. In that case, one of the transactions will show a “Possible duplicate” warning. You can access the actions of that transfer to delete it or, if it was not a duplicate transaction, indicate it so we recognize it as a proper transfer.

As always, if you have questions, just let us know. We are here to help.

Conclusion

The new OpenBanking API is good news for you, but also for us. It allows you to have more control over your data, more banking options, including Revolut Business and (soon) Paypal, and an easier, more understandable and more reliable integration process.

Ignacio Nieto

Ignacio Nieto