Best Digital Banking Solutions for e-residents

In this post, we discussed the pros and cons of opening a traditional bank account vs. opening a digital one, concluding that digital solutions have more advantages unless you have a good reason to opt for a traditional bank account.

In this post, we go deeper into which cases you should open a traditional or digital bank account and which are the best choices for your business, explaining their advantages and disadvantages.

This article deals exclusively with digital solutions for businesses. For your personal finances, there are solutions such as Revolut, N26, or Monzo, which we will talk about in another post.

Are you ready? 😎

Table of contents

What is Digital Banking?

Digital banks are online entities that either have a banking license or work with an entity that has one. They offer a virtual bank account (some of them even one per currency, for example, an IBAN for your euro account, a US account number for a dollar account, etc.) and a debit or credit card.

As a result, you can use them to operate as you would with a traditional bank account: receive payments from your customers, pay your providers, and even use your card for the company’s expenses.

It’s basically like having an account at a traditional bank, with some important differences:

- You can not apply for loans.

- You may not, depending on the fintech, distribute capital either (e.g. for investors or stakeholders).

- You will not earn interest for the money you have accumulated.

- Although you have a unique IBAN, it may not be -depending on the fintech- a “real” bank account, but an address associated with an electronic wallet. However, you can receive payments, send transfers, and operate normally.

- Although your money is safe, and these solutions are 100% reliable, some are not protected by the European Deposit Guarantee Scheme (DGS), as in a traditional bank account. We will talk about how safe your money is with each solution in the following paragraphs. 😉

Should I Open a Traditional Bank Account or a Digital One?

With very few exceptions, it is very rare that your company is going to need a traditional banking solution. Fintech solutions today are more convenient, technologically advanced, and can be opened and managed entirely online.

When is a traditional bank account advisable?

To open a traditional bank account you will need to visit Tallinn at least once and meet with the staff. This is because of the KYC policy -Know your customers-. Basically, they need to guarantee that your business is legitimate and that you are not a terrorist or into money laundering.

Most Estonian traditional banks will apply a monthly fee for their banking services to e-Residents.

For example, LHV charges €10 for e-residents of EU member states, and 20 € for e-residents of other countries.

This is more costly than solutions like Revolut Business, which offers a free plan, but also premium plans with more advantages, to be honest.

So, in which cases having an account in a traditional bank is advisable?

- If you don’t mind visiting Estonia. This is probably the most important factor to consider. If you are a digital nomad, travel regularly, or are attracted by the idea of visiting the Baltic country, do not forget to add the bank offices to your itinerary.

- If you have a good reason for opting for a traditional bank. There are many misunderstandings when it comes to what a traditional bank can offer that an online solution can’t, so don’t hesitate to ask us.

When is a digital solution advisable?

Luckily there are completely digital alternatives to your service. One of the most frequent prejudices we find against this type of solution is the false assumption that they are not “real bank accounts” or there is no “real bank” behind them. Today, with solid Fintech banking companies such as Revolut Business or Paysera, that is simply not true.

Many e-Residents with companies in Estonia operate exclusively with digital solutions.

No matter if you are a startup, a freelancer, or a small or big business owner a digital bank account is a perfect solution for you. You can operate, receive payments from your customers, and have your bank account with IBAN and Swift / BIC, and your card.

You can even start with Revolut Business, for example, and later when you have some free time and your business is well established, take a trip to Estonia if you still think you need a traditional bank.

And the best of all? You can open your company in Estonia and operate it online without stepping into Estonia.

The Top Digital Banking Solutions for e-Residents

So now that you know that a digital banking service may be a good solution for your business, let’s look at some of the best solutions currently available.

1. Revolut Business

Revolut is one of the leaders in the recent disruption of the banking industry. They were one of the very first to offer virtual bank accounts in multiple currencies.

After the success of their personal online banking solution, they launched Revolut Business, aimed at businesses. This account works basically the same as the personal version, but for your business.

The only requirement to request such an account is that your company is established in a European country, like Estonia. However, please note that at least one partner must be a resident in the European Union, the United Kingdom, or Switzerland.

Advantages

✅ Without a doubt, its greatest asset is its App, which is so simple to use that operating with your money online becomes a real pleasure.

If you’ve never used Revolut, the first time you install and start using it, you’ll understand what “the future of banking” means. The experience is just superior to any traditional bank.

You can even track your expenses and categorize them!

✅ You don’t have to pay a monthly fee because it comes with a free plan, although there are different plans at attractive prices with many advantages.

✅ It also allows you to have a multi-currency account. This is very useful if your company operates internationally (with suppliers and customers in other countries), enabling you to make and receive payments in over 25 currencies (EUR, GBP, USD, etc).

✅ Additionally, with the free plan, you can make up to 5 free local transfers. You will only be charged 20 cents for each if you make more.

✅ As for corporate cards, it allows you to create three physical cards (the first one with free shipping) and up to 200 virtual cards per employee. This way, you can manage the company’s day-to-day expenses, and if any team member needs to travel, you can also track expenses in real-time.

✅ If you have an e-commerce business, you might be interested in Revolut Pay. This payment gateway integrates with major e-commerce platforms (WooCommerce, Shopify, PrestaShop). It allows you to accept card payments.

✅ They accept cryptocurrency, commodities, and even gold.

Disadvantages

❌ It is more difficult to open a bank account, as they require more documents. The reason is that they have a banking license, so they can decline your application if they find your business too risky.

❌ From our experience, Revolut can not issue a certificate stating that you have paid the share capital of your company.

2. Wise

Wise, formerly known as TransferWise, also offers many advantages, such as not having to pay a monthly fee, and you can open a bank account and use its card in over 200 countries.

Advantages

✅ Its platform is easy to use.

✅ As mentioned earlier, it does not charge a monthly fee.

✅ It offers low conversion fees and commissions, making it a good option for international money transfers.

✅ It allows you to hold more than 40 currencies in the account, making transactions in different currencies easier.

✅ Unlike traditional banks, Wise has no hidden fees or ongoing maintenance charges, providing clarity in pricing.

✅ It offers debit cards and the option of a virtual Visa debit card for secure online, in-store, and overseas payments.

Disadvantages

❌ They do not accept cash, checks, or cryptocurrencies, but you can receive money into your Wise account from a platform that uses cryptocurrencies, as long as the platform is regulated or supervised in the EU or the UK.

❌ Although you do not pay monthly fees, you do have to pay a €50 commission to open the account.

❌ Your money is not safeguarded by the European Deposit Guarantee Fund (FDG), but it does offer the option to opt for protection under the Estonian Guarantee Fund (GF) up to a value of €20,000 in Europe.

3. Paysera

Paysera is another of the latest contenders to enter the banking arena for e-Residents. Their offer is quite interesting. They grant an IBAN with which you can transfer money in multiple currencies around the world.

Advantages

✅Unlimited and instant transfers in euros, 24/7, throughout the year. International transfers around the world at attractive rates.

✅Real-time currency exchange at fairly affordable rates to 30 different currencies.

✅A contactless payment card for secure payments.

✅A pretty modern mobile app.

✅It is a good option to consider also in case Revolut or Paysera are not suitable for your business model, since Paysera is a much more flexible banking solution.

✅There is no monthly fee and you can open it for free, but you pay a fee for the transfers. You can find more information about the transfer fees here.

Disadvantages

❌ It does not accept cryptocurrency.

❌ Your money is safeguarded, but not guaranteed by the Financial Services Compensation Scheme (FSCS).

This means that all funds transferred to your Paysera accounts are separated from the funds of the company and cannot be used for company needs, loaned, or invested. All money is kept only in reliable credit institutions of the European Union. You can find more information about its safety here.

❌ The card can only be delivered to the EEA countries.

4. Payoneer

Payoneer stands out for its international presence, enabling secure and swift payments in over 190 countries, with the option to open an account in various countries worldwide.

Advantages

✅ Its app is user-friendly.

✅ Payoneer offers the flexibility of a multi-currency account, allowing receipt of payments in different currencies and maintenance of separate balances in those currencies within your account, making it beneficial for frequent international transactions.

✅ It provides a Mastercard debit card that allows you to utilize funds received through the service in nearly any country worldwide, with an annual maintenance fee of $29.99 or €24.99.

✅ Payoneer can be used for purchasing cryptocurrencies, though selling them is not supported.

✅ As a regulated financial institution, customer funds managed by Payoneer are held in segregated and protected accounts in accordance with legal requirements. Your funds are kept in low-risk financial institutions, ensuring liquidity at all times.

✅ The account opening process is quick, with verification and initial approval taking anywhere from minutes to several business days.

✅ There are no monthly fees.

Disadvantages

❌ As mentioned, obtaining a debit card incurs an annual maintenance fee of $29.99 or €24.99.

❌ An annual maintenance fee of $29.95 USD applies if 12 months elapse and you’ve received less than $2000.00 USD (or equivalent) in payments. More information is available here.

If you’re a Companio customer embarking on establishing a new company, you can kickstart your venture by opening your Payoneer account through this link. Already a business owner considering a switch to Companio? You can seamlessly transition by opening your Payoneer account right here.

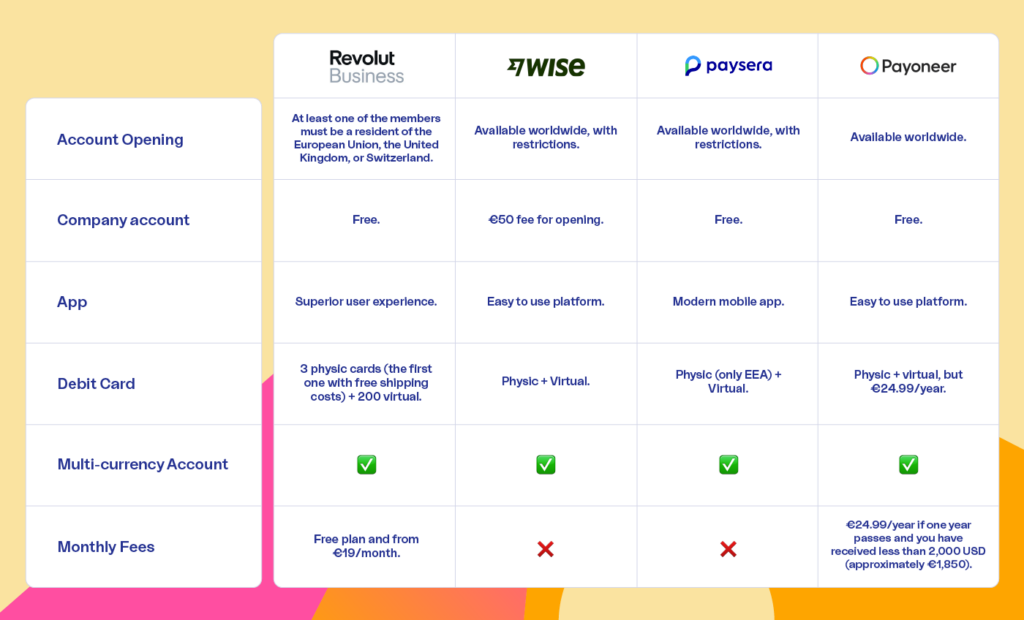

Below is a comparative table summarizing the key pros and cons of these banking solutions:

And the Oscar goes to…

Revolut Business stands out as the best digital banking solution among the top three options for e-residents. Its versatile features and user-friendly interface make it a choice for individuals and businesses globally.

Anyway, if you are a customer of Companio, we will guide you through opening your bank account and offer you the best alternatives for your business.

If you are not from Companio and are interested in launching your online European business with zero hassle, you can find more information about how we can help you here.

Ignacio Nieto

Ignacio Nieto